Buying vs. Renting: The True Cost of Interest Over the Long Run

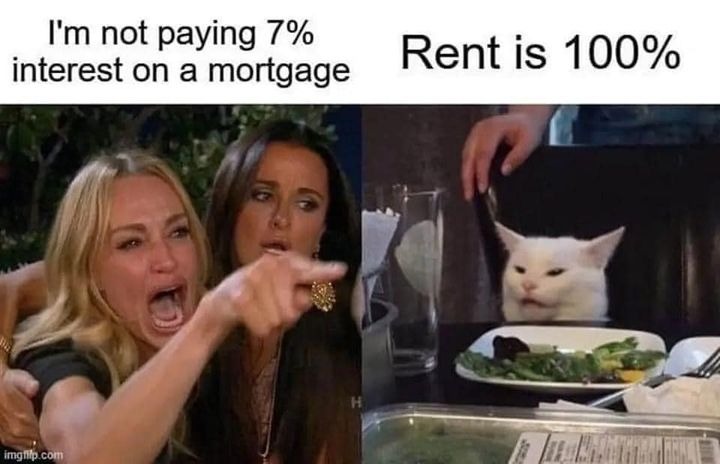

One of the biggest financial decisions that many people face is whether to buy a home or to rent. There are many factors to consider, including lifestyle, location, and finances. For many people, one of the biggest concerns when it comes to buying a home is the interest rate on their mortgage. Many people balk at the idea of paying 7% interest on a mortgage, but what they may not realize is that renting can often cost much more in interest over the long run.

First, let’s take a closer look at what it means to pay 7% interest on a mortgage. When you take out a mortgage, you are essentially borrowing money from a lender to buy a home. The interest rate on the mortgage is the cost of borrowing that money. So, if you take out a $300,000 mortgage with a 7% interest rate, you will end up paying a total of $441,213 over the life of the loan. That’s $141,213 in interest alone.

Now, let’s compare that to renting. When you rent a home or apartment, you are essentially paying for the right to use that property for a set amount of time. While it may seem like renting is cheaper in the short term, it’s important to consider the long-term costs. When you rent, you are essentially paying 100% interest on the property. You are paying for the use of the property without building any equity or ownership.

For example, let’s say you rent a $1,500-per-month apartment for 30 years. Over the course of that time, you will have paid a total of $540,000 in rent. That’s $540,000 in interest alone, without any ownership or equity in the property. In contrast, if you had taken out a mortgage for a $300,000 home and paid it off over 30 years, you would have paid a total of $441,213, but you would own the property outright.

Of course, there are other factors to consider when deciding whether to buy or rent a home. Renting can be a good option for people who are not ready to commit to a specific location or who want more flexibility in their housing situation. However, it’s important to understand the true costs of renting over the long term.

In conclusion, while the idea of paying 7% interest on a mortgage may seem daunting, it’s important to consider the long-term costs of renting. Renting can often end up costing much more in interest over the long run, without any ownership or equity in the property. By contrast, buying a home with a mortgage allows you to build equity and ownership over time, even if the interest rate may seem high at first. Ultimately, the decision to buy or rent a home will depend on your individual circumstances and financial goals.

Join The Discussion